Should you buy a stock right after it splits?

Splits neither improve nor deteriorate the long-term potential returns of stocks. They might drive a short-term movement in the price, but they do not have any material influence over the long term. Therefore, you should never buy a stock solely because the company announced a split.

It's basically a draw, and the value of your investment won't change. However, investors generally react positively to stock splits, partly because these announcements signal that a company's board wants to attract investors by making the price more affordable and increasing the number of shares available.

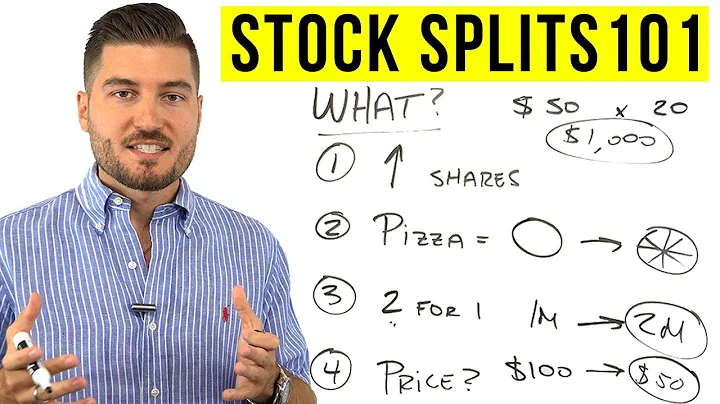

Key Takeaways. In a stock split, a company divides its existing stock into multiple shares to boost liquidity. Companies may also do stock splits to make share prices more attractive. For shareholders, the total dollar value of their investment remains the same because the split doesn't add real value.

One way is to buy shares of the company before the reverse split occurs with the plan to sell them soon afterwards. This can be profitable if the company's stock price increases after the split. Another way to make money from a reverse stock split is to short sell the stock of the company.

A stock split does not change the value of a stock because it does not change the fundamentals or growth prospects of the underlying company.

When you buy a stock after the split date, you will still receive the same proportional ownership in the company as you would have before the split. However, there are a few important things to consider: 1. Adjusted Price: After a stock split, the price per share is typically reduced proportionally.

Disadvantages of a Stock Split

A company cannot rely on a stock split to increase its value or market cap. A stock split divides the existing shares, thus keeping the market cap the same as before. Not to forget, a company must invest some amount to conduct a stock split.

Price Decrease, Increased Liquidity: After a stock split, the price per share typically decreases proportionally to the split ratio (e.g., a 2-for-1 split would halve the price per share). This can make the stock more affordable for retail investors and increase liquidity as more investors can afford to buy the stock.

- Broadcom (NASDAQ:AVGO) is the most expensive stock on this list on a per-share basis. ...

- Deckers Outdoor (NYSE:DECK) is another that needs a stock split. ...

- Nvidia (NASDAQ:NVDA) is no stranger to the spotlight after gaining almost 2,000% over the past five years.

A stock split is when a company divides and increases the number of shares available to buy and sell on an exchange. A stock split lowers its stock price but doesn't weaken its value to current shareholders. It increases the number of shares and might entice would-be buyers to make a purchase.

What is the ideal portfolio split?

If you are a moderate-risk investor, it's best to start with a 60-30-10 or 70-20-10 allocation. Those of you who have a 60-40 allocation can also add a touch of gold to their portfolios for better diversification. If you are conservative, then 50-40-10 or 50-30-20 is a good way to start off on your investment journey.

In How Many Stocks Make a Diversified Portfolio?, Meir Statman concluded that a well-diversified portfolio of randomly chosen stocks must include at least 30 stocks, which contradicted the earlier study and what the author suggested was a then widely accepted notion that the benefits of diversification are virtually ...

Many times reverse splits are viewed negatively, as they signal that a company's share price has declined significantly, possibly putting it at risk of being delisted.

Among the 1206 firms conducting a reverse stock split, we find that, within five years of the reverse split, 138 or about 11% are acquired by another company while 568 or about 47% enter bankruptcy or fail to meet listing standards.

The reverse stock split doesn't cause investors to lose money by itself, but the move can signal to investors that the company is in financial trouble, which can lead to a sell-off. This will lower the value of the stock price, and stockholders will lose money.

A split, in theory, takes the price down to what may be a more attractive or accessible level, while also feeding a notion among existing shareholders that they have "more" than they did before. Splits allow people to buy more shares.

How did the Berkshire Hathaway Class A shares become so expensive? It was a deliberate strategy by Warren Buffett to keep the number of shareholders low. When most companies increase in value, the corporation will “split” shares - give you two shares for each one you have, cutting the price in half.

- Pro: Makes shares more affordable. ...

- Pro: May trigger renewed investor interest. ...

- Con: Could trigger volatility. ...

- Con: Does not add any new value: At least in the short term, the total value of your assets for the stock in question remains the same.

In stocks, a round lot is considered 100 shares or a larger number that can be evenly divided by 100. In bonds, a round lot is usually $100,000 worth. A round lot is often referred to as a normal trading unit and is contrasted with an odd lot.

Apple (AAPL) has split five times. The first split happened in June of 1987. It was a two-for-one split, which means that each shareholder who owned one share of AAPL pre-split subsequently owned two shares.

How to profit from a stock split?

A stock split doesn't add any value to a stock. Instead, it takes one share of a stock and splits it into two shares, reducing its value by half. Current shareholders will hold twice the shares at half the value for each, but the total value doesn't change.

That said, many stocks have shown strong performance after a split. In other words, selling your shares of a stock prior to a split isn't always the best decision – unless, of course, you're not well-positioned to continue holding the stock.

Walmart isn't known for its impressive profit margins, but the chain's earnings power is improving. Operating income spiked in the past year and is projected to outpace revenue again in 2024. It's great news for the business, meanwhile, that these gains arrived even as the company cuts prices amid strong sales growth.

| S.No. | Name | CMP Rs. |

|---|---|---|

| 1. | Guj. Themis Bio. | 408.70 |

| 2. | Refex Industries | 168.05 |

| 3. | Tata Elxsi | 7103.70 |

| 4. | M K Exim India | 91.75 |

Fortunately, analysts see positive earnings and revenue growth for all eleven market sectors this year. The healthcare sector is expected to generate a market-leading 17.8% earnings growth in 2024, while the information technology sector is expected to lead the way with 9.3% revenue growth.